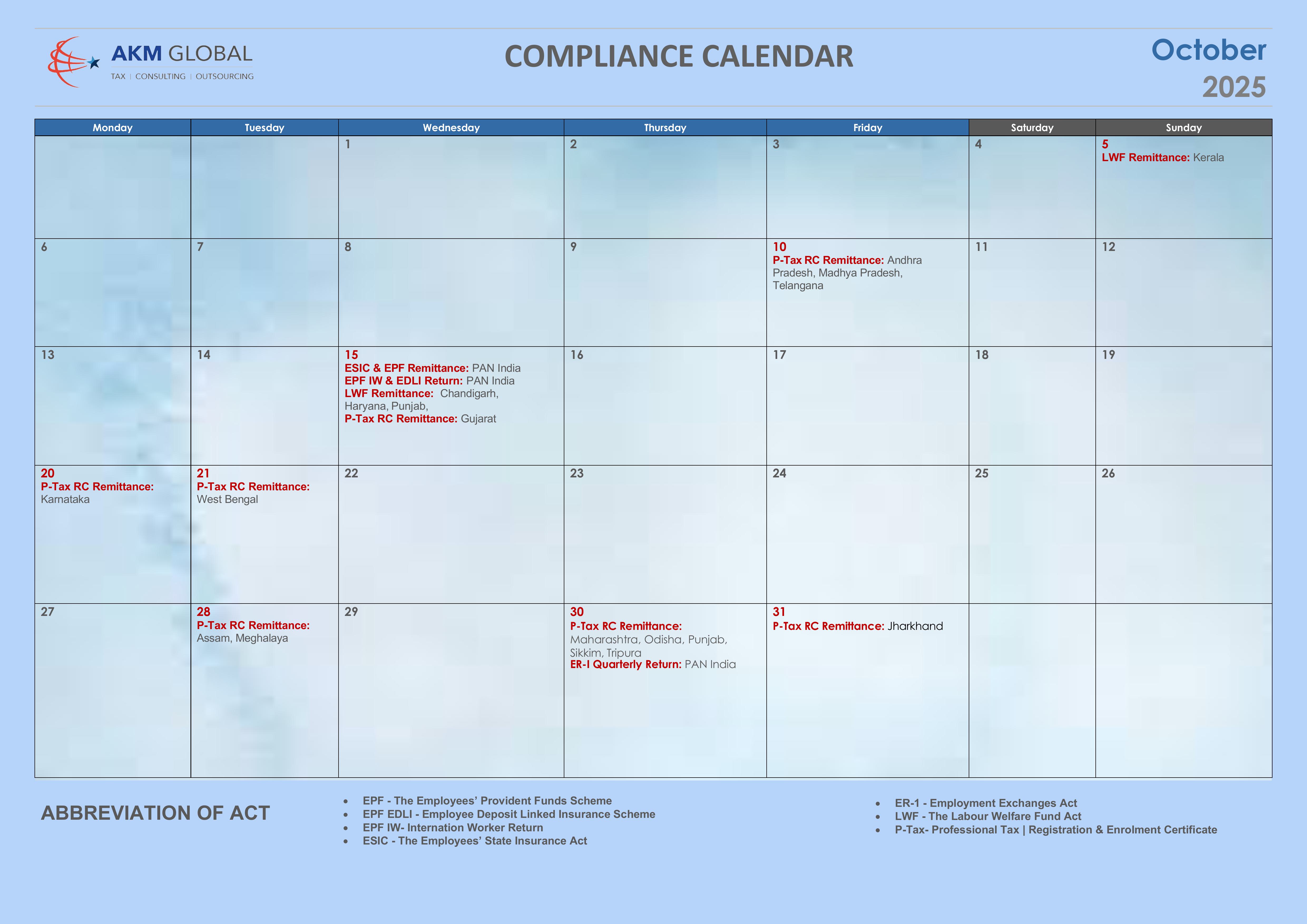

Compliance Calendar October 2025 – Important Due Dates

Created By :

Anoop Kumar | Manager- Labour Law

Staying compliant with statutory deadlines is crucial for businesses, HR teams, and finance professionals to avoid penalties and ensure smooth operations. Below is the Compliance Calendar for October 2025, highlighting the key due dates for Provident Fund (PF), ESIC, Professional Tax (P-Tax), Labour Welfare Fund (LWF), and other statutory filings across India.

Download PDF

Key Compliance Due Dates – October 2025

October 5, 2025

-

Labour Welfare Fund (LWF) Remittance – Kerala

October 10, 2025

-

Professional Tax (P-Tax) Remittance – Andhra Pradesh, Madhya Pradesh, Telangana

October 15, 2025

-

ESIC Payment – PAN India

-

EPF Contribution & Remittance – PAN India

-

EPF International Worker (IW) & EDLI Return – PAN India

-

LWF Remittance – Chandigarh, Haryana, Punjab

-

P-Tax Remittance – Gujarat

October 20, 2025

-

P-Tax Remittance – Karnataka

October 21, 2025

-

P-Tax Remittance – West Bengal

October 28, 2025

-

P-Tax Remittance – Assam, Meghalaya

October 30, 2025

-

P-Tax Remittance – Maharashtra, Odisha, Punjab, Sikkim, Tripura

-

ER-I Quarterly Return – PAN India

October 31, 2025

-

P-Tax Remittance – Jharkhand

Why Compliance Deadlines Matter

Missing statutory deadlines can result in:

-

Heavy penalties and interest charges

-

Legal complications and government notices

-

Disruption in employee benefits like PF and ESIC

By keeping track of the October 2025 compliance calendar, businesses can streamline their HR and payroll processes, ensure timely remittances, and stay legally compliant.

Compliance Abbreviations (Quick Reference)

-

EPF – Employees’ Provident Funds Scheme

-

EDLI – Employees’ Deposit Linked Insurance Scheme

-

EPF IW – International Worker Return under EPF

-

ESIC – Employees’ State Insurance Act

-

ER-I – Employment Exchanges Return (Quarterly)

-

LWF – Labour Welfare Fund

-

P-Tax – Professional Tax (Registration & Enrolment Certificate)

How AKM Global Can Help

At AKM Global, we understand that managing multiple compliance deadlines across states can be overwhelming. Our team of experts provides end-to-end support in:

-

Tracking statutory due dates and filing requirements

-

Ensuring accurate and timely remittances for PF, ESIC, LWF, and Professional Tax

-

Managing payroll compliance across different states in India

-

Reducing risks of penalties, interest charges, and regulatory disputes

With decades of experience in tax, payroll, and compliance management, we help businesses stay compliant, save time, and focus on growth. Contact us now.

FAQs – Compliance Calendar October 2025

1. What is the due date for ESIC in October 2025?

The ESIC contribution for October 2025 is due on October 15, 2025, across India.

2. When is the EPF remittance deadline in October 2025?

Employers must deposit EPF contributions and submit the EPF IW & EDLI Return by October 15, 2025.

3. Which states have Labour Welfare Fund (LWF) remittance in October 2025?

LWF remittances are due on October 1, 2025 (Kerala) and October 15, 2025 (Chandigarh, Haryana, Punjab).

4. What is the ER-I Quarterly Return due date in October 2025?

The ER-I Quarterly Return under the Employment Exchanges Act is due on October 29–30, 2025 (PAN India).

Final Thoughts

The month of October 2025 brings several compliance obligations for employers. Staying ahead of these due dates will ensure smooth operations and legal peace of mind.

Pro Tip: Bookmark this compliance calendar or set automated reminders so your team never misses a deadline.