Applicability of Internal Financial Controls For Private Limited Companies 2025

Threshold Limit for Applicability of Internal Financial Controls (IFC):

Internal Financial controls (IFC) are defined within the explanation to Section 134(5)(e) of the Companies Act 2013 as the policies and procedures adopted by the companies for making

-

certain the orderly and economical conduct of its business,

-

Adherence to company policies

-

Safeguarding of its assets

-

Prevention & deduction of frauds and errors

-

Accuracy & completeness of accounting records

-

Timely preparation of reliable Financial information.

Internal financial controls over financial reporting mean the process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles(GAAP)

Applicability of IFC Under Section 134(5)(e) of the Companies Act, 2013

Section 134(5)(e) of Companies Act,2013 states the applicability of IFC for the following persons:

-

Directors, to state in their Director’s responsibility statement & Board’s Report, whether they had laid down adequate and efficient IFC to be followed by the company

-

Auditors, to additionally present an opinion on whether or not an organization has an adequate internal financial controls (IFC) system in place and also the operation effectiveness of such controls. This should be in addition to the prevailing audit opinion on financial statements.

Internal Financial Controls Over Financial Reporting (ICFR)

Internal financial controls over financial reporting mean the process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles

IFC is applicable solely to all listed entities. It may, however be noted Companies (Accounts) Rules, 2014 needs the Board of Directors’ report of all companies to state the details in respect of adequacy of internal financial controls with regard to the “financial statements”.

Exemptions from IFC Applicability for Private Companies

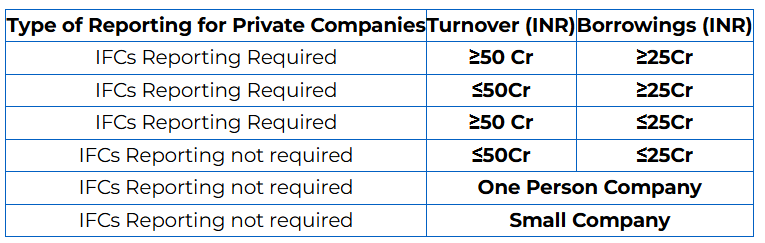

Although, MCA vide its notification dated 13th June 2017 (G.S.R. 583(E)) provided exemption from Applicability of Internal Controls over financial reporting (ICFR Applicability) to following private companies:

-

Which is one-person Company (OPC) or a Small Company; or

-

Which has turnover less than Rs. 50 Crores as per latest audited financial statement or which has aggregate borrowings from banks or financial institutions or anybody corporate at any point of time during the financial year less than Rs. 25 Crore.

Additionally, the above-mentioned Companies will be exempted from IFC Applicability only if it has not committed a default in filing its financial statements under section 137 of the Companies Act 2013 or annual return under section 92 of CA 2013 with the Registrar.

How We Can Assist with IFC Preparation and Compliance

To gain deeper insights into the Applicability of IFC or assistance in preparation of the Risk and Control Matrix along with policies and flowcharts, click here to fill out our form. Our specialized team will provide you with detailed information and support tailored to your needs.